Australia EV Incentives and Rebates: Australia is entering a major transformation in the automotive industry, shifting rapidly toward cleaner, smarter, and more efficient transportation. Electric Vehicles (EVs) are at the center of this revolution, with both federal and state governments introducing a variety of incentives and rebates to encourage adoption.

This article offers a comprehensive breakdown of Australia’s EV incentives and rebates for 2025, explaining who qualifies, how much you can save, and what future changes might be on the horizon. Whether you’re a new buyer or considering upgrading from a petrol car, this guide will help you make an informed decision with real financial insight.

Understanding Why EV Incentives Matter

Electric vehicles help reduce carbon emissions, improve air quality, and lower running costs for drivers. However, the initial price of EVs is often higher than that of traditional vehicles. To bridge this affordability gap, Australian governments at both the national and state levels have introduced incentives such as rebates, tax exemptions, and registration discounts.

These programs aim to:

-

Make EVs more affordable for Australian households

-

Accelerate the transition to a low-emission transport system

-

Support local charging infrastructure and green energy integration

As EV technology becomes more advanced and production scales up, government incentives are expected to evolve. Let’s explore what’s currently available.

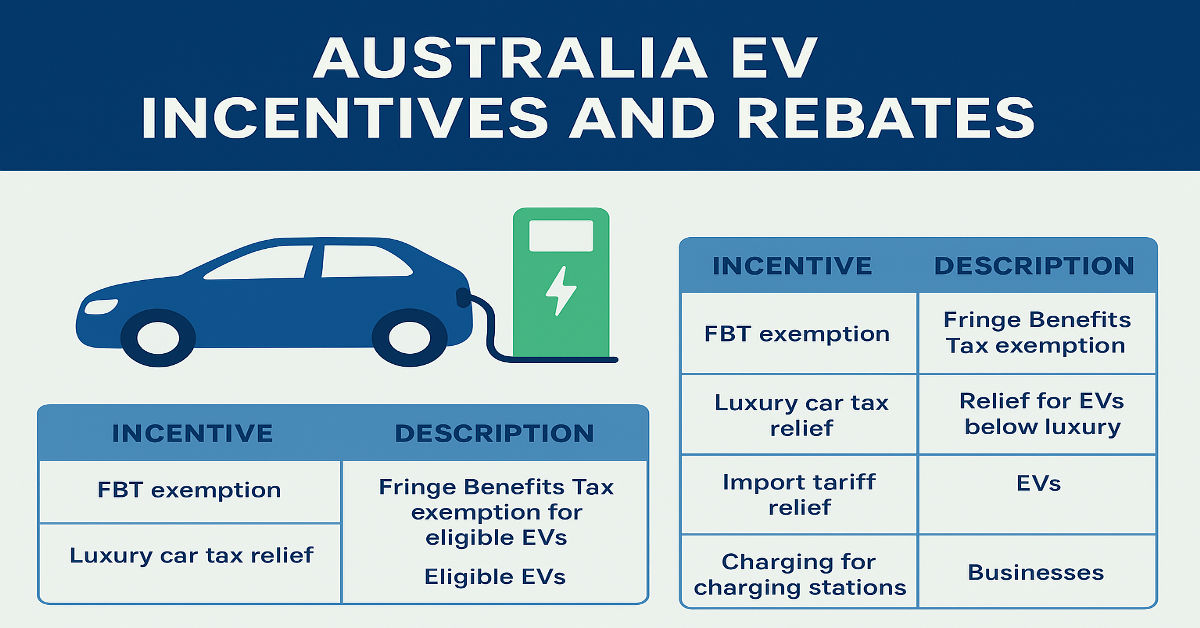

National (Federal) EV Incentives in Australia

At the federal level, Australia has implemented several national incentives designed to encourage EV adoption for individuals and businesses. While the focus is less on direct cash rebates and more on tax and fleet benefits, these incentives can significantly reduce ownership costs.

1. Electric Car Discount (Fringe Benefits Tax Exemption)

One of the most significant national benefits is the Electric Car Discount, which provides a Fringe Benefits Tax (FBT) exemption for eligible electric vehicles.

This allows employers and employees to save thousands of dollars through salary-sacrifice (novated leasing) programs.

| Incentive | Details | Eligibility |

|---|---|---|

| Fringe Benefits Tax (FBT) Exemption | EVs priced below the Luxury Car Tax threshold for fuel-efficient vehicles (around AUD 89,332) are exempt from FBT. | Applies to new battery electric vehicles (BEVs) and hydrogen fuel-cell vehicles purchased by employers for staff use. |

This incentive makes EV leasing an attractive option for many professionals, reducing the effective cost of ownership by 20–40%.

2. Import Tariff and Luxury Car Tax Relief

Electric vehicles priced below the Luxury Car Tax (LCT) threshold for fuel-efficient cars are not subject to additional import tariffs or extra LCT charges. This helps reduce the overall price of premium EV models that meet energy-efficiency standards.

| Program | Description | Vehicle Requirement |

|---|---|---|

| LCT Relief for Fuel-Efficient Cars | Reduces or removes luxury tax for vehicles that emit less than 7.0 L/100 km. | EVs and hybrids under AUD 89,332. |

This incentive benefits higher-priced electric cars such as Tesla Model 3, BYD Seal, and Hyundai Ioniq 6, keeping them competitively priced in the Australian market.

3. National Charging Infrastructure Programs

The federal government also supports the expansion of Australia’s EV charging network through the Driving the Nation Fund and ARENA’s Future Fuels Program.

These programs provide funding to install fast-charging stations nationwide, reducing “range anxiety” and supporting long-distance EV travel.

| Program | Focus | Beneficiaries |

|---|---|---|

| Driving the Nation Fund | $500 million commitment for charging corridors across major highways and regional towns. | Charging network operators, local councils, dealerships. |

| Future Fuels Program (ARENA) | Supports workplace and fleet charging infrastructure. | Businesses and local governments. |

Although these are not direct rebates for buyers, they make EV ownership more practical and convenient for everyone.

State and Territory EV Incentives and Rebates

EV incentives vary widely between Australian states and territories. Each jurisdiction sets its own policies for rebates, registration discounts, and home-charger support.

Below is a complete state-by-state guide for 2025.

| State/Territory | Incentives Offered | Key Details and Notes |

|---|---|---|

| Australian Capital Territory (ACT) | – No stamp duty for new or used zero-emission vehicles – Up to two years of free registration – Interest-free loans (up to $15,000) for EV purchase or charger installation |

The ACT offers the most comprehensive ongoing incentives in Australia, aiming for 90% zero-emission vehicle sales by 2030. |

| New South Wales (NSW) | – $3,000 rebate and stamp duty exemption (ended January 2024) – Ongoing EV registration concessions |

While direct rebates have ended, NSW continues to support low-emission vehicle registration discounts. |

| Queensland (QLD) | – $6,000 rebate for new EVs under $68,750 (ended Sept 2024) – Reduced registration and duty fees |

The rebate has closed, but reduced costs still apply for EV ownership and road use. |

| Victoria (VIC) | – $3,000 Zero Emission Vehicle Subsidy (ended June 2023) – Discounted registration rates remain |

The Victorian government has phased out its main rebate but still supports long-term registration benefits. |

| South Australia (SA) | – Three-year registration exemption for new EVs under $68,750 (until June 2025) – Past $3,000 rebates now closed |

SA focuses on registration savings for new EV purchases within the valid window. |

| Western Australia (WA) | – $3,500 rebate for EVs under $70,000 (closed May 2025) – Ongoing support for public charging stations |

WA previously offered one of the most generous cash rebates, now replaced by infrastructure focus. |

| Tasmania (TAS) | – $2,000 rebate for new and used EVs (closed April 2024) – Interest-free loans for chargers |

Tasmania is prioritizing green loans over direct rebates moving forward. |

| Northern Territory (NT) | – $1,500 stamp duty concession – Up to five years’ free registration – $1,000 grant for home charger installation |

The NT continues to offer strong purchase and registration incentives through 2027. |

Comparing the Value of Incentives Across Australia

The value of incentives depends on both vehicle price and buyer location. Below is a simplified comparison of potential savings for a new EV priced at AUD 65,000 in each jurisdiction.

| State | Estimated Incentive Value | Effective Cost After Incentive |

|---|---|---|

| ACT | Around $4,000–$6,000 (tax, registration, and loan benefits) | ~$59,000 |

| SA | Approx. $1,500–$2,500 (registration exemption) | ~$62,500 |

| NT | Around $2,500–$3,000 (stamp duty + registration + charger grant) | ~$62,000 |

| NSW | Rebates closed; minor savings on registration | ~$63,000 |

| QLD | Rebates closed; small rego savings | ~$63,000 |

| VIC | No cash rebate; only registration relief | ~$63,500 |

| TAS | No direct rebate; loan support | ~$64,000 |

| WA | Rebate closed (May 2025) | ~$64,000 |

The ACT and Northern Territory currently offer the best ongoing financial benefits for new EV owners in 2025.

Additional Incentives for Businesses and Fleets

EV adoption among commercial fleets is crucial for reducing national emissions and building a used-EV market.

The federal FBT exemption is particularly valuable for companies offering EVs to employees under salary-sacrifice or fleet arrangements.

Key business benefits include:

-

Fringe Benefits Tax exemption for qualifying EVs

-

Reduced fuel and maintenance costs per vehicle

-

Access to federal and state fleet grants (for charging infrastructure)

-

Accelerated depreciation for EVs in business use

As a result, many Australian companies now offer EV leasing options through novated lease programs, significantly improving accessibility for everyday employees.

EV Home Charging Support and Incentives

Charging convenience is essential for EV adoption. Some state governments also provide rebates or loans to support home-charger installation.

| State | Charger Support | Description |

|---|---|---|

| ACT | Interest-free loans up to $15,000 | Can be used for vehicle or home-charger installation. |

| NT | $1,000 home-charger grant | Reimbursed after proof of installation. |

| NSW, VIC, QLD | Limited to commercial or community charging grants | No direct home-charger rebates currently available. |

Home charging is typically the most affordable and efficient way to power your EV, and installing a Level 2 charger can cost between $1,000 and $2,500 before any rebates.

How to Apply for EV Incentives and Rebates

Applying for EV incentives in Australia involves a few key steps:

-

Check your eligibility – Confirm your EV meets the price and emissions requirements.

-

Purchase from an eligible dealer – Ensure the dealer is approved for the rebate or discount.

-

Apply online – Most state rebate applications are handled through Service portals (e.g., Service NSW, SA Gov, etc.).

-

Provide required documents – Submit proof of purchase, registration, and identification.

-

Receive rebate or credit – Most rebates are credited to your bank account within 6–8 weeks after approval.

Always verify application deadlines, as many programs have cut-off dates linked to the vehicle purchase or registration date.

Future of EV Incentives in Australia

The landscape of EV incentives is dynamic. As adoption grows and EV prices fall, governments are gradually reducing direct subsidies and shifting focus toward infrastructure investment and tax reforms.

Trends to watch include:

-

Expansion of federal charging corridors under the Driving the Nation Fund

-

Increased focus on fleet electrification across corporate and government sectors

-

Possible introduction of road-user charges for EVs to replace lost fuel excise revenue

-

Growth of battery-recycling programs and used-EV financing support

-

Development of national EV strategy targets for 2030 and beyond

By 2030, most experts expect that EVs will reach price parity with internal combustion engine (ICE) vehicles, even without rebates. At that point, incentives will likely shift toward maintaining grid balance, battery efficiency, and sustainability in the EV supply chain.

Economic and Environmental Impact

Australia’s EV incentives have had measurable success in driving adoption. According to the Federal Chamber of Automotive Industries (FCAI), EVs accounted for nearly 10% of new car sales in 2024, up from just 2% two years earlier.

This growth has encouraged automakers to introduce more affordable EV models, such as BYD Dolphin, MG4, and Hyundai Kona Electric, which qualify for state incentives.

Environmentally, increased EV uptake supports Australia’s national goal of achieving net-zero emissions by 2050. Every EV sold contributes to reduced tailpipe pollution, cleaner cities, and energy security through renewable power integration.

Tips for Maximizing EV Savings

-

Choose an eligible model: Check if your EV is under the price threshold and qualifies for FBT or LCT benefits.

-

Act before program closures: State rebates often close without much notice.

-

Consider salary-sacrifice: Leasing an EV through your employer can provide significant tax advantages.

-

Install a home charger: Reduces reliance on public charging and cuts running costs.

-

Take advantage of energy tariffs: Many utilities offer off-peak EV charging plans with discounted electricity rates.

-

Monitor government websites: Incentive details can change every financial year.

Expert Insight: The Future of EV Affordability

According to energy economists and automotive analysts, the next few years will see EVs become increasingly affordable due to three factors:

-

Global manufacturing scale reducing production costs

-

Battery technology improvements increasing range and lowering cost per kWh

-

Local assembly incentives as Australia explores EV component manufacturing

By 2026–2027, it is expected that even without rebates, EVs will compete directly with petrol vehicles on total cost of ownership. This will further accelerate adoption, especially in urban regions with mature charging networks.

Frequently Asked Questions (FAQs)

1. Are EV incentives available for used electric cars?

Some states, such as the ACT and Tasmania (before April 2024), offered incentives for used EVs. As of 2025, most current programs target new purchases, but used-car policies may return in future.

2. Can I combine federal and state EV incentives?

Yes. Buyers can benefit from both national tax exemptions (like FBT relief) and state-level registration or rebate schemes if eligible.

3. Do plug-in hybrids qualify for EV rebates?

Only a few programs include plug-in hybrid vehicles (PHEVs). Most states prioritize battery-electric vehicles (BEVs) for zero-emission benefits.

4. What happens if I move states after buying my EV?

Your incentive is based on where the car was first registered. Moving later doesn’t affect previously approved rebates.

5. Are business EV purchases treated differently?

Yes. Businesses enjoy FBT exemptions, possible instant-asset write-offs, and federal fleet funding opportunities.

Conclusion

Australia’s EV incentive system plays a critical role in helping consumers transition to cleaner, more efficient vehicles. Although several direct cash rebates have ended across states like NSW, QLD, and VIC, ongoing programs such as the FBT exemption, registration discounts, and charging support schemes continue to make electric cars financially appealing.

For buyers in 2025, the most favorable incentives remain in the ACT, South Australia, and Northern Territory, while the rest of the nation focuses on long-term infrastructure and fleet electrification.

As EV prices decline and infrastructure expands, Australia’s commitment to sustainable transport becomes clearer. If you are planning to buy an electric car, the key takeaway is to act quickly, check state eligibility rules, and combine available programs to maximize your savings.